In today’s digital landscape, small business owners are constantly being pulled in multiple directions—manage social media, run ads, build a website, respond to reviews, analyse data, and somehow still have time to run the business itself. That’s where a unified marketing toolkit becomes invaluable. Rather than juggling multiple platforms, each with its own interface, rules, and subscription, tools like the SEI tool and Terminology tools bring it all together in one streamlined ecosystem. This centralisation not only saves time but also provides clarity, consistency, and confidence in decision-making.

One of the key advantages of a unified toolkit is the ability to see your entire marketing performance in one place. Instead of bouncing between analytics dashboards, email campaign reports, and review platforms, you have a single point of reference. This holistic view gives business owners a stronger grasp of what’s working and what isn’t. It becomes easier to identify trends, adjust strategies, and allocate resources without guesswork.

Clarity in marketing isn’t just about numbers. It’s about knowing what your brand is saying, how it’s being heard, and where it needs refinement. A well-integrated toolkit helps you align language, tone, and messaging across every channel—website, social, email, and paid ads. This alignment creates a consistent customer experience, which builds trust over time. When every touchpoint tells the same story, your business becomes more memorable and easier to connect with.

Another major benefit of using an all-in-one marketing suite is efficiency. Managing multiple tools means managing multiple logins, learning curves, and technical hiccups. It’s easy to waste time troubleshooting rather than strategising. A unified system reduces the complexity. You don’t need to hire separate experts for every platform or constantly retrain staff on new tools. You and your team can focus on what matters: delivering value to customers and growing the business.

For small businesses in particular, budget plays a big role in tool selection. A unified toolkit often comes at a fraction of the cost of paying for five or six separate software subscriptions. But beyond affordability, the real value lies in the synergy between tools. When features are designed to work together—such as analytics that inform content planning, or community features that support peer learning—the results are more impactful. Each element enhances the other.

For small businesses in particular, budget plays a big role in tool selection. A unified toolkit often comes at a fraction of the cost of paying for five or six separate software subscriptions. But beyond affordability, the real value lies in the synergy between tools. When features are designed to work together—such as analytics that inform content planning, or community features that support peer learning—the results are more impactful. Each element enhances the other.

Training and onboarding are also simplified with a centralised system. Whether you’re hiring new staff, outsourcing to freelancers, or just getting started yourself, it’s easier to learn one toolkit deeply than many superficially. When education is built into the platform—offering how-to guides, tutorials, and expert tips—users become more confident and proactive. This leads to faster results and less reliance on trial and error.

Another aspect often overlooked is the benefit of using a single system. Marketing can be overwhelming. The jargon, the ever-changing algorithms, the pressure to “keep up”—it creates anxiety and decision fatigue. A clear, well-designed toolkit removes much of this stress. It empowers business owners to take control without being marketers by trade. With better visibility and easier tools, you feel more grounded and capable. That emotional clarity makes a big difference in the day-to-day running of a business.

Flexibility is another strength. A unified toolkit typically supports multiple business models—service-based, product-based, eCommerce, or in-person. Whether you’re launching a new product line or building a lead funnel, you don’t have to switch platforms to adapt. The system grows with you. This scalability means that your marketing infrastructure doesn’t need to be rebuilt every time you pivot or expand.

Perhaps one of the most underrated benefits is the ability to connect with a like-minded community. When a marketing toolkit includes a learning hub or peer support space, it helps users stay inspired and supported. Whether through webinars, case studies, or simple Q&As, this human element makes the experience less isolating. You realise you’re not alone in your challenges—and you can learn from others facing similar ones.

From a strategic standpoint, having everything under one roof also enhances accountability. It becomes easier to set clear goals, track progress, and assign responsibility. Whether you’re working with a team or solo, having central access to insights, performance data, and tasks ensures that efforts are focused and outcomes are measurable. No more hoping things work—you know if they do.

Ultimately, a unified marketing toolkit isn’t just about convenience. It’s about alignment. It brings your tools, team, strategy, and results into one direction. That alignment builds momentum. You’re not spending energy trying to stitch together systems or chase analytics—you’re moving forward with purpose.

In the long term, this integrated approach translates to better brand recognition, higher conversion rates, and stronger customer loyalty. People engage with businesses that appear confident, consistent, and easy to understand. A well-managed toolkit helps you project those qualities without needing an in-house marketing department.

Choosing the right unified platform may take some research, but the payoff is substantial. Look for a toolkit that’s built specifically for small business owners—not enterprise solutions pretending to scale down. It should feel approachable, transparent, and human. If it includes access to guidance, educational content, and a supportive network, that’s even better. These are the signs of a system built for people, not just performance.

In conclusion, the benefits of using a unified marketing toolkit go far beyond saving time. It’s about bringing everything together—your messaging, tools, data, and decisions—into a single, supportive space. When that happens, clarity replaces chaos, confidence replaces confusion, and progress becomes something you can see and measure. For small businesses ready to grow without the guesswork, it’s one of the smartest investments you can make.

The first step is to get a clear picture of your current financial situation. Make a complete list of all assets, including your family home, investment properties, bank accounts, superannuation, shares, vehicles, and valuable personal items. Equally important is listing any debts—such as mortgages, credit cards, car loans, and personal loans.

The first step is to get a clear picture of your current financial situation. Make a complete list of all assets, including your family home, investment properties, bank accounts, superannuation, shares, vehicles, and valuable personal items. Equally important is listing any debts—such as mortgages, credit cards, car loans, and personal loans. Diversification has always been a cornerstone of solid investing, but today, it’s about more than just spreading capital across stocks and bonds. Modern investors are expanding into alternative asset classes—private equity, infrastructure, sustainable assets, and intellectual property. The focus is shifting toward investing in sectors that can weather economic cycles and offer scalability. For instance, tech startups in AI and green energy are attracting capital due to their potential for exponential growth and alignment with future global demands.

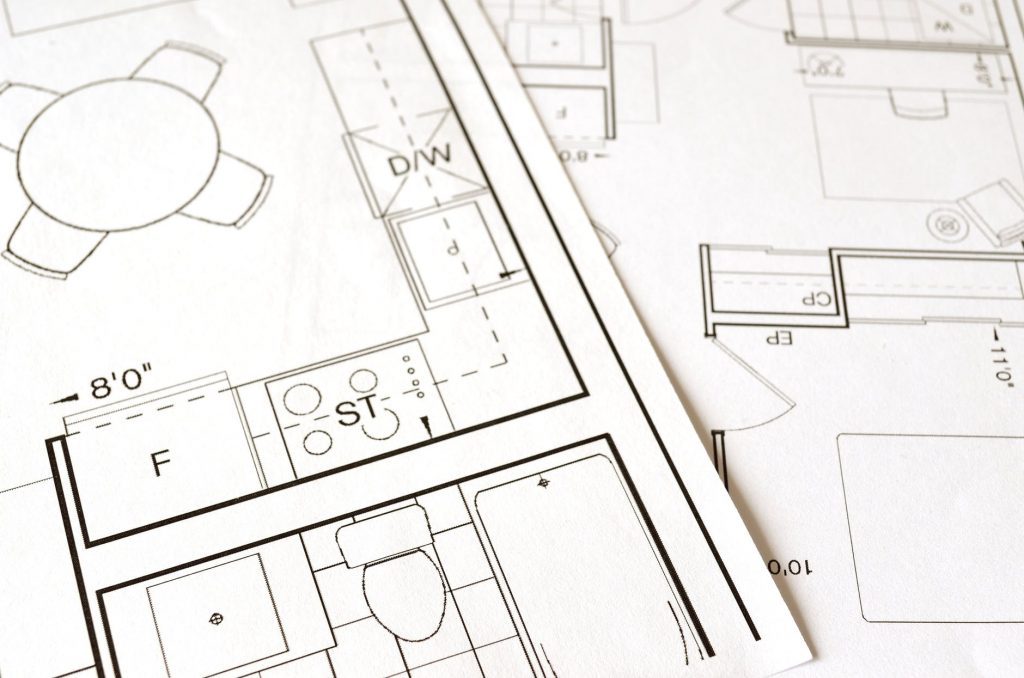

Diversification has always been a cornerstone of solid investing, but today, it’s about more than just spreading capital across stocks and bonds. Modern investors are expanding into alternative asset classes—private equity, infrastructure, sustainable assets, and intellectual property. The focus is shifting toward investing in sectors that can weather economic cycles and offer scalability. For instance, tech startups in AI and green energy are attracting capital due to their potential for exponential growth and alignment with future global demands. Colour plays a major role in modern interior styling. Neutral tones like whites, greys, and beiges offer a timeless backdrop and allow other elements like lighting and texture to take centre stage. For those seeking a bit more flair, muted blues or earthy greens can add character without overwhelming the senses. The goal is cohesion—a seamless flow from one space to another that feels both spacious and inviting.

Colour plays a major role in modern interior styling. Neutral tones like whites, greys, and beiges offer a timeless backdrop and allow other elements like lighting and texture to take centre stage. For those seeking a bit more flair, muted blues or earthy greens can add character without overwhelming the senses. The goal is cohesion—a seamless flow from one space to another that feels both spacious and inviting. At the heart of this issue is the legal concept of duty.

At the heart of this issue is the legal concept of duty.